The Power of a One-Stop Insurance Solution in Newburgh, IN

Running a business in Southern, IN, comes with a unique set of responsibilities, challenges, and risks, and protecting your business with comprehensive coverage is important. From managing employees to growing your customer base, the last thing you want is an unexpected setback due to inadequate insurance coverage. That’s where a one-stop insurance agency like Paradise Insurance makes all the difference.

As an independent agency serving businesses in Boonville, Newburgh, Chandler, Carmi, Princeton, Mt. Vernon, Mt. Carmel, Henderson, Owensboro, and Jasper, we have access to multiple carriers. Whether your business needs general liability coverage, workers’ compensation, or industry-specific policies, we provide tailored solutions that protect your assets and support your long-term success. Business insurance isn’t just about meeting legal requirements—it’s about securing your future.

6 Risks of Not Having the Right Business Insurance

Without the right coverage, your business is vulnerable to financial loss, legal liability, and missed opportunities. Here’s why securing proper insurance is crucial:

1. Increased Financial Risk

A single disaster—fire, theft, cyberattack, or lawsuit—can be devastating. Without proper insurance, you may have to cover losses out of pocket, jeopardizing your business’s financial stability. The right insurance safeguards your assets and ensures that an unexpected event won’t derail your success.

2. Legal Liabilities That Could Shut You Down

Accidents happen, and lawsuits can stem from property damage, employee injuries, or customer disputes. Without business liability insurance, your company could face costly legal battles that threaten its survival. Liability coverage gives you peace of mind so you can focus on running your business.

3. Business Debt Default Consequences

Uninsured losses can make it difficult to meet payroll, pay vendors, or cover loan obligations, leading to damaged credit, higher borrowing costs, or even bankruptcy. Business insurance provides a safety net, ensuring that one unfortunate event doesn’t lead to long-term financial trouble.

4. Insufficient Coverage Can Leave You Exposed

Many business owners underestimate the amount of coverage they need. Your industry, employee count, and operational scope all play a role in determining the right policy. As your business grows, so do your risks—making regular coverage assessments essential. At Paradise Insurance, we ensure that you have adequate protection at every stage of your business journey.

5. Missed Growth Opportunities

Lack of insurance can limit your company’s ability to expand. Many lenders, landlords, and clients require proof of coverage before engaging in contracts. Without necessary policies like general liability, workers' compensation, or property insurance, you could miss out on lucrative opportunities to grow your business.

6. Inadequate Protection for Employees

Your employees are your greatest asset, and protecting them should be a priority. From workers’ compensation to health insurance and liability coverage, ensuring that your team is properly covered fosters loyalty and keeps operations running smoothly. A one-stop insurance provider like Paradise Insurance ensures that your business and employees receive the best coverage available.

Get the Right Coverage with Paradise Insurance

At Paradise Insurance, we believe business owners in Newburgh, Boonville, Chandler, Carmi, Princeton, Mt. Vernon, Mt. Carmel, Henderson, Owensboro, and Jasper shouldn’t have to navigate the complexities of insurance alone. With access to multiple carriers, we customize coverage to meet your specific needs—whether it’s general business policies, specialized industry coverage, or employee benefits. No matter how unique your business requirements are, we have a solution that fits.

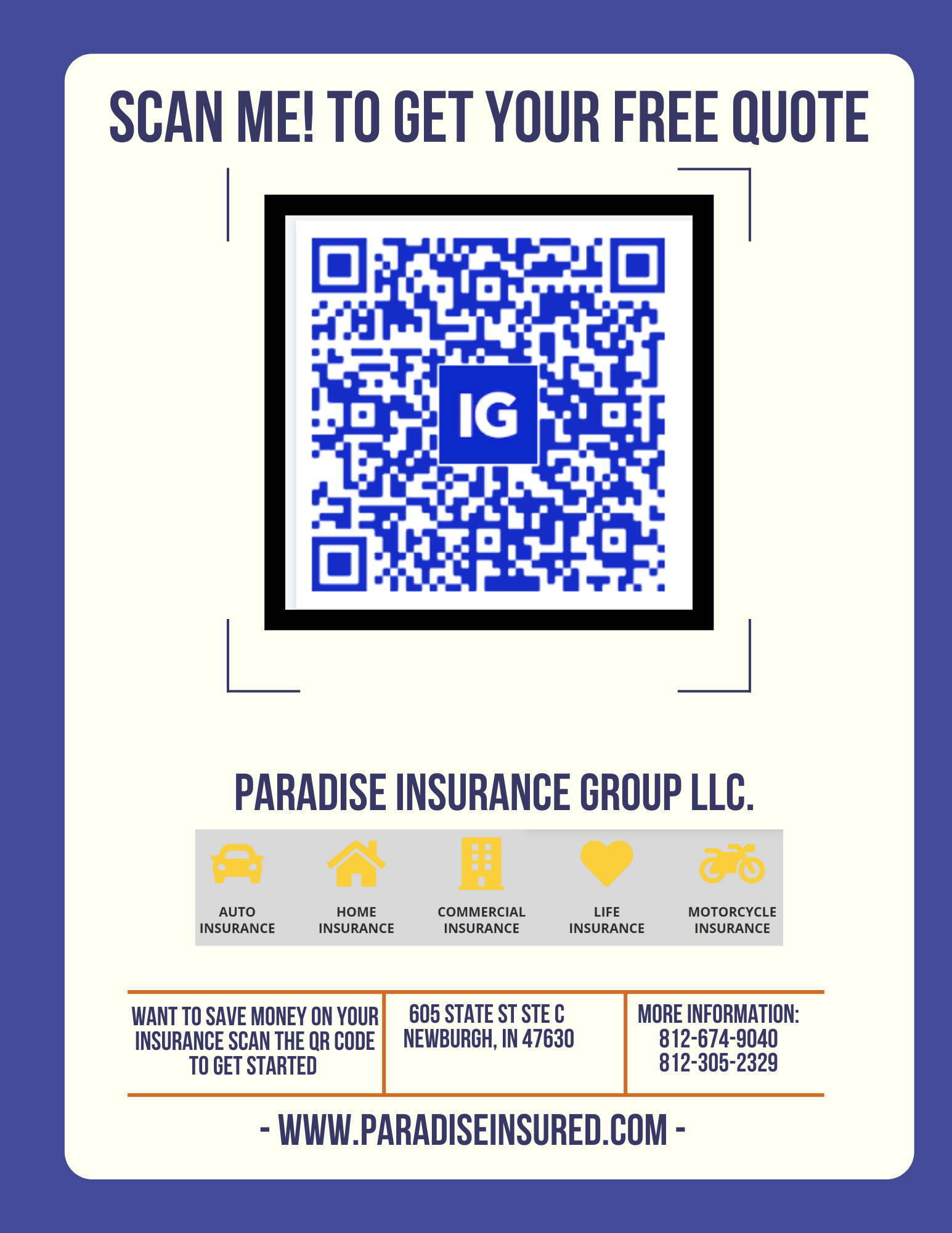

Don’t leave your business exposed to unnecessary risks. Learn more about insurance solutions tailored to your business and contact Paradise Insurance today at

812-674-9040 for a free consultation. As your trusted local experts, we’ll make sure your business is fully protected and set up for long-term success!

Quick Links

Contact Information

Phone: (812) 674-9040

Fax: (812) 720-3832

Email: jdavis@paradiseinsured.com

Address: 605 State St. Suite C Newburgh, IN 47630

Business Hour: 24/7